Let’s go on another Prop firm, one of the newer players in the hood called “True Forex Funds”

this is no review about performance, quality, or any other metric for the firm or myself!

the purpose is to lay out the real-life progression and experiences with TrueForexFunds in terms of “Trading as a Business”.

just signing up and making some profit is not the same as “being profitable” in the sense of the business itself.

There is a financial and time investment to consider!

Everything does look like the marketing is from myForexFunds (even the name) and rules like FTMO

that could mean “best of both worlds” or “just a copycat”? but that isn’t for me to decide.

here are the things that do stand out so far:

- Pricing is “just a bit cheaper” than FTMO

100k challenge is 499 EUR (FTMO charges 540 EUR) - Challenge targets are just a bit smaller than FTMO with the same Drawdown limits

5/10% Drawdown for 8% Profit in phase1 and 4% in phase 2

and they have no Minimum Trading Days (which does not make a big difference anyway but i guess it’s good for marketing) - other than the rules, everything else is very much copied from MyForexFunds

like the name, even the discord channel layout has the same icons in the names

(which makes it impossible to refer to a channel without developer mode active)

- NO Refunds!

once you purchased, you either fail or go through all the way to Profit split, there is no other way to get the money back!

they make this very clear in the Terms of Service and the dedicated Refund Policy. (not a hidden thing at all) - MyFxbook doesn’t recognize them as a Broker (probably not yet listed)

as a result, you can’t add accounts to MyFxbook - it appears that at least part of the infrastructure is from Match-Trade Technologies.

- The Company was Registered in October 2021. under the name True Proprietary Funds Kft. (limited liability)

with 3m HUF Registered capital (about 8000 USD). located in Hungary (here)

one listed person (Richárd Nagy, aged 24 when listed (March 2022) [Instagram / screenshot of an IG post]

Biz Log in the Google spreadsheet below, followed by the events that happened so far

what happened so far:

- because there is no refund i will start with the smallest account they offer

10k, 8% profit target 5%intraday 10% max Drawdown. - ordered while chatting with a support agent that answered all the questions regarding scaling, copy trading and a few other normal things.

paid via BTC, let’s see how long that takes. - 20 minutes after payment was completed I got an MT4 account, added it to Duplikum,

it’s Friday evening so no trade to be done, I just made a few quick scalps on Nasdaq to test things out.

- sadly I can’t add the account to MyFxBook, because the broker isn’t listed and support chat has no clue about it 😉

- here is a view of the Spread during the US Session

- it’s Saturday, I’m bored, well let’s check on ToS of the firm regarding weekends.

they do “allow weekend positions” and BTCUSD is active, so let’s try that one out real quick. - the weekend spreads on BTC are surprisingly small, but the execution is a total nightmare,

i made a screen recording showcasing the execution speed on YouTube - May 15: the execution issue got worse, did some vwap scalping that went horribly wrong.

- time for revenge! purchased another account (25k this time)

bought ETH on the vwap with 1% risk and poof, Passed in less than 2 hours 😉

- it says I have to wait a bit (usually 1 biz day) for the phase 2 account.

- 7 Hours later (keep in mind i qualified during the weekend!) the Phase 2 account is ready.

- there was a great opportunity on ETH, i took it with a 0.7% risk and qualified this account as well in less than 90 minutes 😉

- accounts were confirmed, I had to do the KYC and confirm a Contract (just click “i agree” essentially.

however, the support is refusing to give me this document as a pdf/image or even a link. first red flag? - well turned out this was just a language barrier, everything turned out just fine,

the contract can be seen after the KYC is complete. in the dashboard

(it’s however just HTML, i will download and recompile it to make sure it’s not altered after) 🙂

also need to ask them some questions about the NDA they include. but i will do that in a few days.

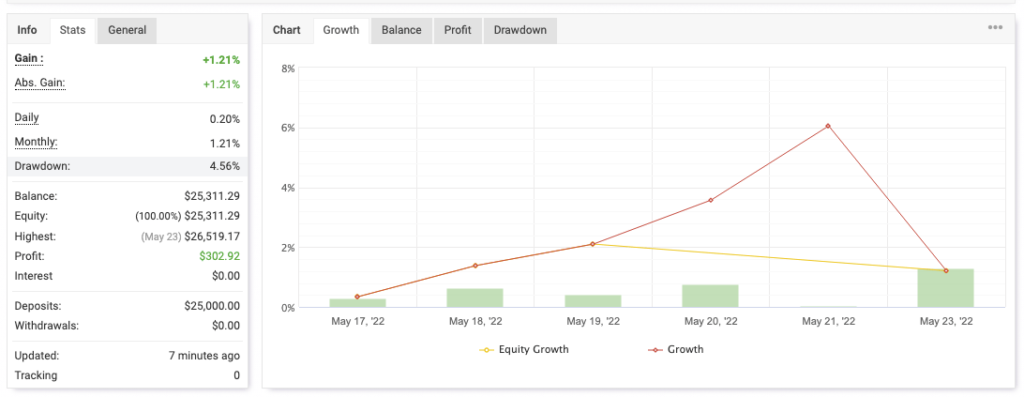

- May 17: Funded account is Ready, it’s a Demo account, but that is according to the agreement, so everything is fine so far)

Buying some ETH to Initialize the account and a quick DAX Scalp to test the Copy-Service

will copy this account with 3x of my main account you can see Live on YouTube daily. - May 23: the account was set to put on 4times the risk, which resulted in some offset in my hedge positions, I noticed it too late,

and the account got disqualified today (it’s still in profit, yet it’s failed, well that’s on me! time for a do-over) - can’t share the live data from MyFxbook (this firm is not listed so they can’t be verified)