Quick Business overview: MyForexFunds

this is no review about performance, quality, or any other metric for the firm or myself!

the purpose is to lay out the real-life progression in terms of “Trading as a Business”.

This page is to show that there is a process in terms of conducting business and actually making some money!

just signing up and making some profit is not the same as “being profitable” in the sense of the business itself.

There is a financial and time investment to consider!

just signing up and making some profit is not the same as “being profitable” in the sense of the business itself.

There is a financial and time investment to consider!

Opting for the “Accelerated Program” for serval reasons:

- Time is not an issue as you trade live on Day 1

- it seems fair, as you essentially pay the risk in advance,

this has the effect that the firm will care very little about what you are doing as they running it pretty much risk-free. - Evaluations in general carry a major conflict of interest,

as the firm has by default an incentive in selling you accounts.

this statement does not imply any wrongdoing, just pointing out that there is a misalignment in the commercial application and the archived goal.

lots of firms do this successfully and are trustworthy at the same time. - if the Firm does the evaluation as an “interview process” that’s, of course, a different thing then.

- If you know what you are doing, there is really no reason to “evaluate yourself”

- if the cost (paying risk in advance) is an issue for you. (in terms you can’t pay for a better option),

Prop trading is not for you! (seriously!)

- What happened so far:

- Purchased a 10k Accelerated account

- miserably failed due to an error on position size translation on Indicies.

it opened full contracts as default (100% my own mistake) - Purchased a 50k Accelerated account

- that had some crypto issues, that turned out to be an integration error on the MFF systems.

the issues resulted in me having now 20 USD on the MFF wallet, but it was all sorted out by the live-support in less than 2 days. - no payout on the first Weekend (i started mid-week but was required to have at least 5 trading days to qualify for a payout.

- lost some money the following week (quite substantial DD actually), but got it all back.

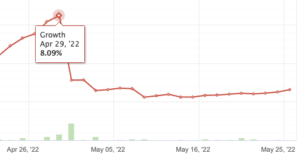

- the week after, the first money to came in (January 15) reducing the exposure by 8% (creating an initial ROI of 8.6%)

- The next payment came in 2 weeks after.

which just took 2 days to process (from request until hitting my Bank account) reducing the Risk by 17% (ROI to 26%) - the following week another payment reduced the risk by another 19% (ROI to 46%)

this time it just took 6 hours (from MFF request to the actual Bank account) - forgot to remove all pending orders and 2 open positions yesterday one order opened on CNC (F40) into the massive gap down

massive huge drawdown this will take forever to recover, will add another account. (and another 2450 USD to the expense list)

this could be avoided, but that would also mean no income during the recovery (at least 1 month, not really want to wait this long) - beginning of March, with an overall ROI of 10.52%, some issues rising where MyForexFunds refuses to pay out profits.

- March 16, all issues were resolved regarding the copy trade/signal issues. the firm promptly paid the outstanding amounts via Deel.

- April 17, everything seems to go smoothly now. (7 Payments after the drama)

I do now attach to every payment request the track record of the master account that actually provides the trades.

not a big deal, so let’s just keep doing this 😉 - ROI is now back at 35% (after trashing one of the accounts, the other one is just short of 1% away from the upgrade)

- 43 days in one account reached the Scaleup target, let’s see how that goes now in terms of processing.

- The upgrade could not be easier, after rollover a button appeared to “upgrade”, clicked it

old account was instantly disabled, and a new account was added. setting the active equity to 150k USD - the following day the rollover balance from the deactivated account was paid to my Deel account as normal.

- May 2: biggest Payout yet over 2500 USD (bringing ROI to 60.3%)

- May 10: that streak didn’t last very long, went into a deep rabbit hole!

have to pay the price, reducing ROI to 52% - 21 May: having a 7.02% profit, this time I will request the payout without providing evidence for the copy activity.

let’s see if the copy drama has calmed down. - 22 May: confirmed, no more drama, paid immediately, no problem at all.

this payment also moved the ROI back over the previous level (before the dip) to 62.7% - 23 May: today pushed the ROI over 65%, and will add another account (this will push ROI back to 55%)

- 29 May: small payout due to overtrading on two accounts, need to get them back to 50k .. steady but slowly